How to Reduce Technical Debt During Liferay DXP Upgrades: A Modernization Guide

Upgrades shouldn’t slow innovation. Discover how Liferay and Veriday help teams reduce technical debt and evolve digital experiences without disruption.

Evolution is driven by disruption. As species compete to dominate a habitat, forces of disruption provide opportunities for new and evolving species to establish themselves. A similar phenomenon happens in the business realm, where these disruptions take the form of speed and innovation. Global-scale disruptions such as the industrial revolutions have shaped and reshaped the way economies are structured and operate. This has led to the downfall of many companies and the rise of others. At the current churn rate, about half of today’s S&P 500 firms will be replaced over the next 10 years. The ability for an organization to embrace change in an agile way begets success in riding transformative waves. Whereas, holding fast to existing methods while these waves crash is a sure path to being left behind in the marketplace.

The impact of digital transformation on industrial companies who face particularly unique challenges are typically industries associated with high barriers to entry like automotive or aerospace and defense, have seen increasing threats from new entrants with the success of Tesla, SpaceX, and Blue Origin. The threat of substitutes is making traditional business models obsolete as crowdsourcing and peer-to-peer apps disintermediate manufacturers from the customer lifecycle as we’ve seen with Uber, Airbnb, and other digital natives. Industrial companies face not only the digital forces that are shifting the way companies and customers communicate with the world, but also the physical changes in the machine, product, and human capabilities that these digital forces drive.

Most industrial enterprises are still in the early phases of Digital Experience (DX) adoption. With some examples of early proof of concept initiatives beginning to be rolled out. As they do so, there are notable early successes and trends identified by digital pioneers on this new frontier of innovation. They have taken on large-scale technology initiatives and integrations and have illuminated the untapped potential DX will have in the industrial world. Shifting from largely experimental programs and homegrown implementations, the current state of DX for industrial companies in heavy asset-intensive verticals including manufacturing, utilities, and transportation, is categorized by solutions that accelerate time to value, the scaling up of proven use cases and digital business infrastructure, and new attitudes and acceptance toward emerging technologies.

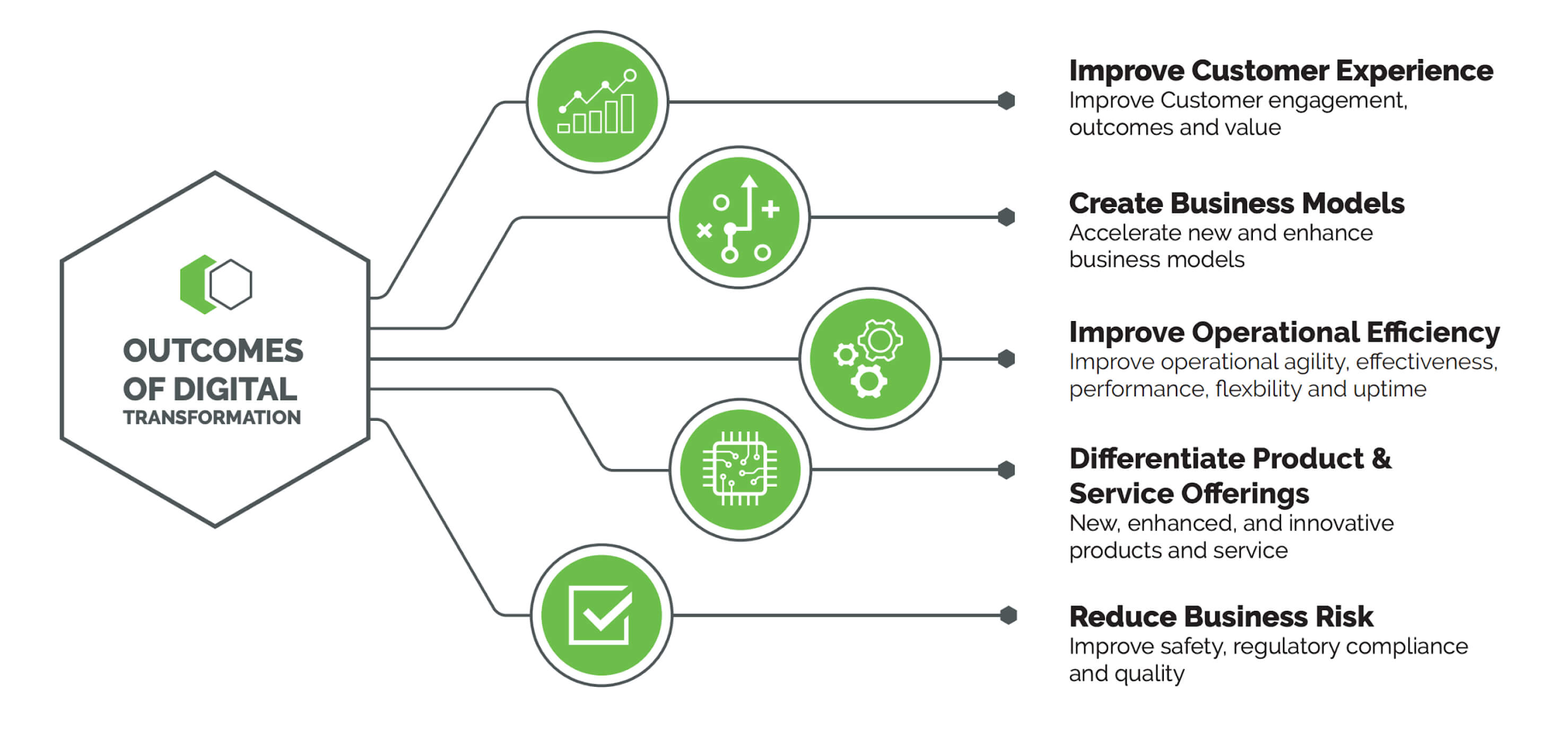

Across industry surveys of executives and practitioners, our analysis uncovered some common opportunities. With a myriad of global forces disrupting the way industrial enterprises do business, DX must be approached with a mix-and-match strategy that starts with goals unique to each industrial company, their competitive landscape, strengths, and weaknesses. From this virtually endless menu of goals that business leaders are being advised to pursue, we’ve distilled the key drivers of change in industrial markets to five overarching outcomes that are fundamental to the success of DX initiatives.

• 39% of technology and business decision makers cite reduce costs as a DX driver (Forrester)

• ‘New efficiencies are still the primary driver for large companies to invest in new technologies.’ (WEF/Accenture)

• 42% of DX strategists and executives cite operational efficiencies as a top metric for tracking DX progress (Altimeter, a Prophet Company)

Technologies that involve automation and data analysis are improving these metrics by facilitating change to processes. Companies can now apply connected technologies to gain visibility into their operations where only stopwatches and speculation existed previously. Applied correctly, these technologies can be used to identify inefficiencies and a company with a proactive strategy can develop agile processes that allow them to capitalize on the insights this visibility brings. Wasted time and materials can be avoided through this constant analysis and optimization. Furthermore, automation capabilities are improving operational effectiveness by unlocking new levels of quality and consistency from machine assets.

• 50% or more B2B companies will differentiate themselves offering easier, more personalized, more connected purchasing experiences’ (B2B Online)

• 25% of technology and business decision-makers cite product and service innovation as a DX driver (Forrester)

• 46% of DX strategies and executives claim evolving customer behaviors and preferences as a key driver of DX (Altimeter, a Prophet Company)

Differentiation is a core driver for many industrial companies, especially for product manufacturers that often compete in crowded markets. DX can enable differentiation of product and service offerings by creating opportunities for new capabilities and optimizing current product and service delivery. The key measures of differentiation show up in time to market, rate of new product or feature introductions, and improved product quality. To achieve these goals, enterprises are leveraging technology to better understand their products and create proactive enhancements that set them apart from the competition. Examples include real-time simulation of product changes and improved collaboration across the value chain from design through service. Augmented reality is differentiating value propositions and additive manufacturing is enabling net-new design possibilities, meaning technology is being used to drive a state of constant change and adaptation. Closing the loop between the planned and realized value propositions, companies can quickly recognize customer needs and go to market faster with solutions that better meet their customer requirements.

• 41% of technology and business decision makers are looking to improve the customer experience through DX (Forrester)

• 75% of consumers are more likely to make a purchase from a company that knows their name and purchase history and recommends products based on their preferences. (Accenture)

• 71% of executives view understanding the impact digital technology will have on their customer’s behavior and preferences as their top challenge (Altimeter, a Prophet Company)

Organizations across the globe are recognizing that customer-centricity is fundamental to their DX strategies and to effectively compete in the digital marketplace. Buyers expect customizable products and experiences and for issues to be addressed in real-time or before challenges arise. Digital interfaces and communication coupled with new services are strengthening customer engagements and brand reputation. From Net Promoter Scores to increased service revenues, customer experience can now be measured in more meaningful and actionable ways than ever before. At the core of this new normal of customer, success is the ability to create more intimate relationships with customers through technology capabilities and building a culture of customer-centricity. Extending the customer lifecycles can be achieved with use cases like equipping aftermarket services with customer intelligence that monitors the performance of deployed products, enabling more proactive service and upselling to meet customer demands and avoid unplanned challenges. It can also take the form of new direct communication channels to achieve and accelerate customer time to value, as is the case with guided maintenance and remote service enabled by connected product monitoring.

• 41% of executives cite new business models as the top DX driver (Forbes Insights)

• 30% of industry revenues will come from new business models by 2020. (WEF/Accenture)

• “Companies are recognizing that digital customers increasingly demand high-quality experiences and guaranteed outcomes, rather than just products and services. This development is leading to new, outcome-based business models.” (WEF/Accenture)

There is a massive shift of companies moving from selling standalone products, to providing end-to-end services or for manufacturers ‘products as-a-service.’ As customer expectations rise, buyers become more cautious about large capital spend and prefer the reduced commitment offered by usage or outcome-based business models. Buyers are experiencing the same uncertainty and rate of change as providers, and the ‘servitization’ of all things has emerged as a way for both parties to mutually reach value. These new business models shift traditional metrics like top-line growth by recognizing service and future recurring revenue as equally or more important than current sales. Traditionally, the monetization of products has ended at the point-of sale; however, with the proliferation of digital capabilities including cloud computing, mobile applications, and IoT, services and related revenue can be gained post-sale. There are many examples of this ‘on-demand’ business model proliferating through industries with the development of the ‘sharing economy.’ For industrial enterprises, this business model transformation is creating the opportunity to offer new SLAs that promise specific pay-per-value outcomes for customers – and these new SLAs come at a profitable new price.

• 21% of technology and business decision makers cite regulatory compliance as a DX driver (Forrester)

• 42% of companies cited IT security and risk management as the main focus of digital transformation efforts (HBR)

• 39% of DX strategies and executives claim new standards in regulatory & compliance as a key driver of DX (Altimeter, a Prophet Company)

Risk is more of a driver of change for industrial enterprises than ever before. Between the shifting buyer-supplier dynamics we’ve discussed and uncertain global trade and regulatory conditions, companies simultaneously cannot afford to take risks and yet are required to take them. Supply chains have become more complex, and materials and goods move globally at breakneck speed. Yet many industrial companies still rely on heavy use of paper to do business, where information can be challenging to interpret, maintain, and scale, creating compounding compliance hurdles. Risk can be measured by the number of compliance incidents such as worker safety incidents, data loss, or with product and service liability and warranty claims.

DX technology being applied to meet these ends and reduce risk by enabling smarter decision making and more calculated risk taking, as well as yielding fast reactions when challenges arise. This is prevalent in mission-critical industries like pharmaceuticals or automotive, where performance is crucial and regulatory compliance with Food and Drug Administration (FDA) or the National Highway Traffic Safety Administration (NHTSA) is continuously top-of-mind. Analytical capabilities and connected technologies are providing real-time compliance reporting systems such as plant risk assessments, work forecasting systems, and quality inspection reviews. Connecting workers can alleviate overhead costs for OSHA standards and health and safety (HSE) policies, while connecting physical assets can verify critical systems such as infrastructure are properly functioning. Regulatory compliance has historically been an organizational hurdle; however, DX adopters are not just using technology to comply but differentiate and drive new business value.

Whether enterprises are just starting out or building on existing DX initiatives, it’s crucial to align business needs with the desired value or outcomes and the DX technology and solution to achieve it. Often a combination of multiple technologies as well as people-driven process transformation are required to achieve true differentiation. DX initiatives frequently fail when companies rely too heavily on one silver bullet technology rather than taking a holistic approach to their transformation strategy. Complementary capabilities of multiple technologies are required to enact step change to transform products, processes, and people. Navigating these interdependencies can be daunting and complex. Identifying strategic partners that recognize, understand, and can guide industrial enterprises through these choices is critical. From discovery stages aligning overall objectives and priorities, through proof-of-concept trials, and implementing enterprise-wide solutions at scale, it takes a small army to drive true transformation. Applying strategic technologies to the right outcomes will expedite time-to-value and drive industrial companies through disruptive waves and enable them to ride the momentum of the digital revolution.

How To Align Business Strategy With Robotic Process Automation

How To Align Business Strategy With Robotic Process Automation