Insurers are investing in core transformations of systems, including billing and claims. But some fail to capitalize on their agent network travel the last mile.

Based on our experience, many companies have not yet realized the full value of their core transformation investments because they have not extended their work to include their primary customer connection (e.g. agents). While their core transformations are advancing their operational capabilities into the 21st century, they need to prioritize digital strategies to fuel growth, including how a carrier engages with its clients, how it manages social media and search engine optimization. More effectively aligning these engagement strategies with the field makes agent portals the cornerstone of a digital strategy.

I want to outline key considerations that we think Property and Casualty (P&C) and Life, Health & Wealth technology executives need to weigh when designing and implementing agent portals. These executives will face decisions ranging from which benefits they hope to achieve and what types of architecture flexibility they’ll need, to how they should coordinate agent portal development with related core agent transformation projects.

Well-designed Agent portals improve client and agent engagement creating two-way connections, simplified compliance and brand management, and spur new client acquisition. Agent Portals are more than online marketing and branding tools by offering unique agent capabilities for quoting, claims management, and renewal management they can accelerate business outcomes and position your firm as the carrier of choice for agents. By following a structured portal implementation approach that aligns with the digital strategy and offers unique capabilities targeted at their user bases, carriers can make the most of their portal and core investments. A portal can be the place policyholders go to research and buy insurance, submit claims and pay bills, and update coverage as their financial needs change. It can also be the place where agents go to obtain quotes, transmit claims data, and renew policies. In short, a portal can be an anchor for the carriers’ brand identity, a cornerstone of a digital strategy that emphasizes branding and client centricity in an age of continually rising client expectations.

Portals are the cornerstone of a client-centric digital strategy that helps achieve business outcomes

Decisions, decisions: The problem with portals

The endless options, continual advances in software, and rapid changes in the business landscape make portal implementation complex.

Carriers need an integrated strategy and a clear focus on client needs to develop portals that deliver a unique brand experience and drive growth.

We’ve seen many companies stumble into common mistakes.

These include:

• “One size fits all”: Some carriers don’t consider the specific needs of respective user communities, or personas when building portals. The personas could be policyholders, agents, or employees. When carriers try to serve several personas equally with their portals, carriers run the risk of serving none of them well.

• Technology for the sake of technology: When carriers fast track their portal development to a particular technology solution, they miss the opportunity to truly differentiate themselves by focusing on competencies that complement their business models.

• Failing to optimize the timing of portal rollouts: Portals are closely integrated with core systems and, therefore, the timing of the initial portal implementation—as well as subsequent updates—must be carefully sequenced against other core system upgrades.

Focus on capabilities

Your portal should help you achieve your business goals in the digital domain.

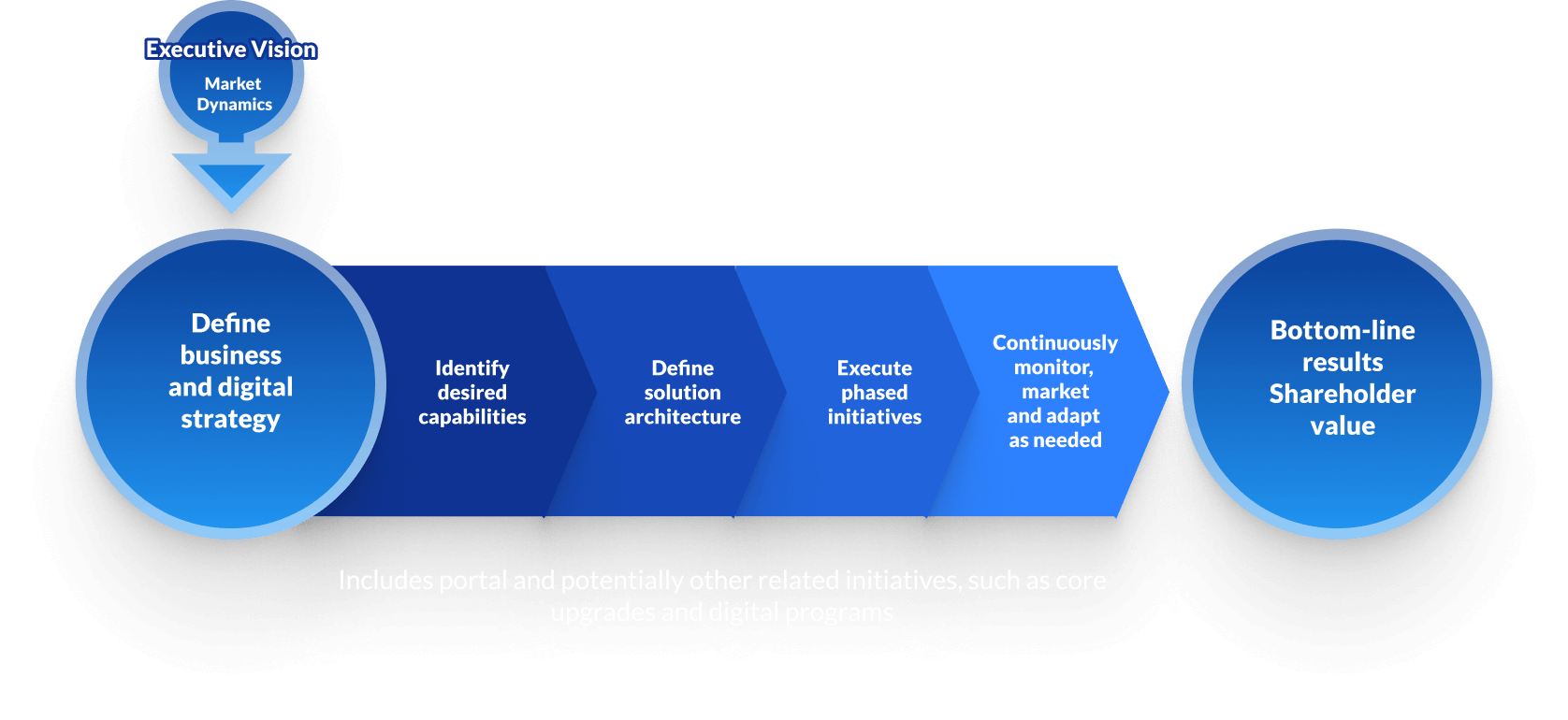

Once you understand how to use your portal to define your brand and support your business objectives, it will become clearer how to select and implement a portal solution from the many options available. Our approach outlines three steps:

• Step 1: Use a capabilities-driven approach to help you tailor the portal for your most critical user communities. Identify the capabilities and experience differentiators a portal solution can provide for different users.

• Step 2: Evaluate portal solution options: Identify what’s at stake by analyzing growth objectives and the competitive landscape. The answer to this question helps inform decisions about how much to spend and how quickly you need to implement a new portal.

• Step 3: Balance expected business benefits, costs, and risks when planning the timing of the implementation. When making this decision, consider how you’ve prioritized client and operational needs against cost and technical constraints, as well as the desire to minimize rework and maintain a positive user experience throughout the change.